- The Italian valves and faucets sector had a turnover of 9.55 billion euros in 2024 (+1.8% over 2023), with exports accounting for 63% of revenues.

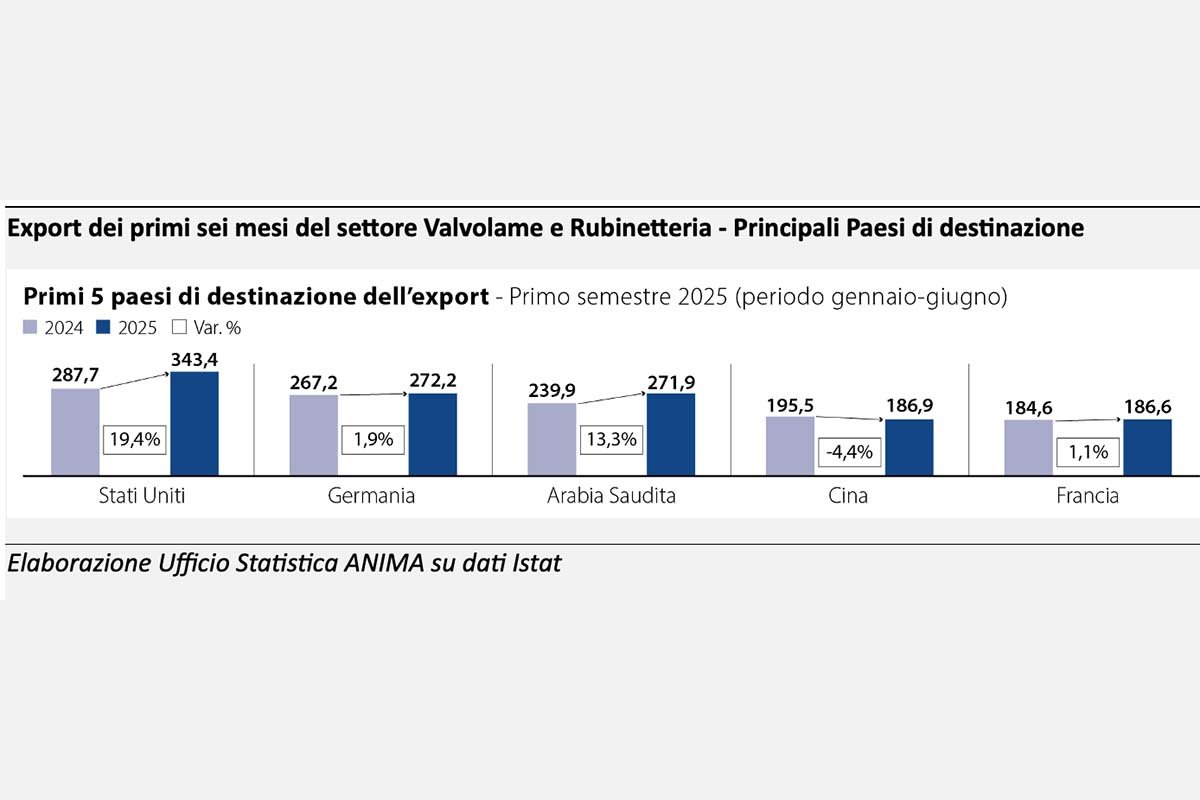

- Exports also increased by 4.6% in the first half of 2025, reaching a turnover of over 3 billion euros. Among the destination countries, revenues from the United States, Germany, and Saudi Arabia are growing, while those from China are decreasing.

- The Ateco code "Other taps and valves" is in eighth place in the ranking of the top ten Italian products by trade balance in 2024, with a value of 5.3 billion euros.

- During the assembly in Milan, 12 international associations (from the USA, Japan, Germany, France, and the United Kingdom) were present for the "Milan White Paper," the shared position paper on hydrogen, nuclear power, and energy.

- Main risk factors for 2026: tariffs towards the United States, excessive bureaucratic and customs burden, devaluation of the dollar, increase in the price of copper, structural shortage of qualified personnel, and impact of the regulatory framework. Furthermore, the energy sector is a challenge for improving the competitiveness of companies, with energy prices remaining among the highest in the EU.

According to data from the Statistics Office of Anima Confindustria, presented in Milan on 24 October by Sandro Bonomi, President of the Italian Association of Valve and Tap Manufacturers (federated with Anima Confindustria) during the annual meeting of AVR members, in 2024 the sector reached a turnover of 9.55 billion euros, recording a growth of 1.8% compared to 2023. Exports remain the main driver of the sector, representing 63% of revenues.

Also in the first half of 2025, sales abroad grew by 4.6% compared to the same period of the year. Previously, exceeding 3 billion euros.

Among destination countries, in the first six months of the year compared to the same period in 2024, the United States confirmed its leading position both in terms of export share (11.3%, equal to 343.4 million euros) and growth (+19.4%). It is followed by Germany, with a share of 8.9% (272.2 million euros, +1.9%) and Saudi Arabia, also at 8.9% (271.9 million euros, +13.3%). China, with a share of 6.1% (186.9 million euros), instead recorded a contraction of 4.4%.

A strategic sector, as emerges from the analysis presented by Marco Fortis, Vice President of the Edison Foundation: the Ateco code "Other taps and valves" is in eighth place in the ranking of the top ten Italian products (4-digit Ateco) for trade balance in 2024, with a value of 5.3 billion euros[1], ahead of sectors such as basic pharmaceuticals and automotive components.

The assembly highlights positive signs for the development of the sector, but also critical issues that could affect the competitiveness of companies.

Among the opportunities, the trade agreement between the European Union and Mercosur countries opens up new spaces for growth, providing for the gradual elimination of duties on over 90% of industrial products: an agreement that offers the Italian valves and taps sector the possibility of Strengthen its presence in South America—particularly in Brazil and Argentina—and diversify export flows, reducing, as much as possible, dependence on markets subject to tariff tensions.

Among the risk factors, however, is the uncertainty surrounding tariffs on the United States, the sector's primary destination market, which could lead to a decline in turnover in the coming years that is currently difficult to quantify.

Added to this are further risk factors: excessive bureaucratic and customs burdens, which significantly increase the work required for exports, diverting resources from production and sales; the structural shortage of qualified personnel, particularly technical and specialized figures; the impact of changes in the regulatory framework, which could penalize Italian companies; the loss of competitiveness due to the strengthening of the euro against the US dollar; and the significant increase in the price of copper, which appears likely to continue in the coming years. Furthermore, particular attention will need to be paid to the energy sector, whose costs, among the highest in the EU, directly impact Italian companies. Nuclear, hydrogen, and the transition to clean energy sources are therefore the challenges for making our companies more competitive compared to other countries.

"The valves and taps sector represents global excellence: a highly specialized sector, recognized worldwide for its quality, innovation, and ability to serve complex markets," says Sandro Bonomi, President of Avr. "Our companies today face significant structural challenges: bureaucratic complexity, tariffs, the lack of qualified technical personnel, and energy costs, among the highest in the EU, represent concrete obstacles to growth and competitiveness. At this stage, it is essential that institutions and the Government collaborate closely with associations and companies to preserve a sector that is currently worth almost 10 billion euros and remains strategic for the entire country system. Today's meeting was an essential opportunity for discussion on the future of the sector, thanks also to the presence of political representatives, international associations and market experts. A fundamental opportunity to consolidate the global reputation of the Italian valve and faucet industry, an emblem of innovation and Made in Italy quality.”

The agenda of the annual AVR members' meeting

The meeting brought together institutional representatives, economists, geopolitical analysts, industry operators and 12 international associations from the United States, Japan, Germany, France, the United Kingdom and other countries, gathered in Milan for the "Milan White Paper", the shared position paper on hydrogen, nuclear power and energy, confirming the Lombardy capital as a global point of reference for the industry and highlighting the strength of exports, the economic importance and the strategic role of Made in Italy.

After the initial speeches by Sandro Bonomi, President of AVR, and Marco Fortis, Vice President of the Edison Foundation, moderated by Greta Cristini, analyst geopolitics, the assembly was divided into five thematic open panels:

- Human Capital: Skills for the growth of the sector

- Energy and Industry: Clean Industrial Deal, energy and industry at the heart of the transition

- Hydrogen and Nuclear: Italian perspectives in the new energy context

- Water / Chemistry: Water Resilience Strategy, DWD, PFAS, Lead, Chromium VI

- Sustainability and compliance: Safeguarding the competitiveness of the industry between CBAM and taxonomy.

The assembly focused on the future of the sector, with a focus on the new Italian nuclear power, which will be presented at the World Nuclear Exhibition, the world nuclear fair in Paris on November 4th with an Italian group of 28 companies created thanks to the Italian Trade Agency and the Ministry of Foreign Affairs and International Cooperation. of International Cooperation proposed by ANIMA Confindustria, and on developments in hydrogen, sectors in which Italian valves are essential components. Furthermore, innovative training and production process management methods for SMEs were explored, with the aim of supporting the growth of the sector in global markets.

The meeting was attended by several members of the European Parliament and Italian parliamentarians from the Energy Commission, including the Hon. Paolo Inselvini, the Hon. Vinicio Peluffo, the Hon. Luca Squeri, the Hon. Luca Toccalini, the Hon. Isabella Tovaglieri, the Hon. Mariateresa Vivaldini, and the Hon. Silvia Sardone and Davide Carlo Caparini, Councilor of the Lombardy Region, presented the institutional perspective on the sector's energy and trade policies.

AVR is the ANIMA Confindustria federated industrial association that represents Italian companies in the valves and faucets sector. In 2024, the sector achieved a turnover of 9.55 billion euros, with an export/turnover share exceeding 60% (data from the Anima Research Office).

ANIMA Confindustria Meccanica Varia is the industrial trade organization that, within Confindustria, represents companies in the various and related mechanical engineering sectors, a sector that employs 221,700 people for a turnover of 56 billion euros and an export/turnover share of 60% (data from the Anima Research Office). The macro-sectors represented by ANIMA are: construction and infrastructure; material handling and logistics; food production; energy production; industrial production; safety and environment.

Industriale.it certification

Industriale.it certification